With the dawn of the 2022 Toyota Corolla, this unassuming compact sedan embarks on its twelfth-generation journey. When encountering an automobile model boasting such enduring longevity, the signs are clear that it has found its stride.

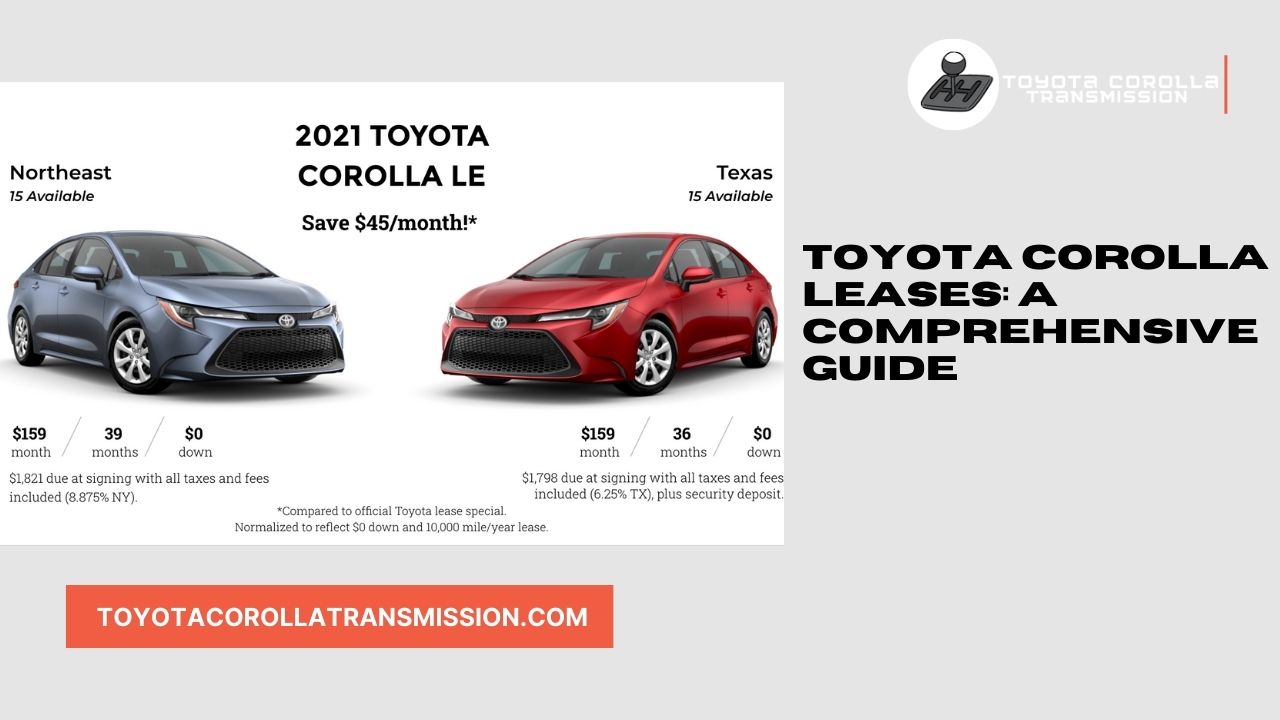

A substantial contributor to the Corolla’s triumphant journey is its unwavering reliability and an appealingly modest price tag. Given its economical pricing, most individuals lean towards purchasing a Corolla rather than leasing. Nevertheless, there is still a possibility that a Toyota Corolla lease might align with your preferences.

Toyota Corolla leases have piqued the curiosity of many of our readers, and we are delighted to respond to their queries. We present a comprehensive guide, shedding light on the essentials of procuring a Toyota Corolla lease. We recommend perusing this guide before making a beeline for your local Toyota dealership.

👀Look at this: Toyota Corolla Transmission Problems

What Does a Toyota Corolla Lease Entail, and How Does It Operate?

Comprehending car leases’ intricacies and mechanisms ensures a favorable experience. A lease serves as a means to “borrow” an automobile from the dealership, distinct from the conventional path of outright purchase via auto loans. Typically, car leases encompass contracts spanning two to four years, and monthly payments adhere to a distinct calculation method compared to standard car loans.

In contrast to making payments towards the Corolla’s purchase price, the lessee (the individual borrowing the vehicle) issues monthly payments that encompass the car’s depreciation costs. The dealership evaluates the vehicle’s initial value versus its residual value (the car’s worth upon lease expiration). The discrepancy between the two, representing depreciation costs, is subsequently divided into monthly payments, including taxes and interest.

For example, if one were to lease a vehicle with a $20,000 price tag, and the dealership forecasts a residual value of $8,000 after three years, monthly payments would amount to $333, covering depreciation expenses.

Like other forms of loans, a higher credit score translates to lower interest rates and, subsequently, reduced monthly payments. Post-lease, potential extra fees might come into play, such as charges for exceeding mileage limits and addressing excessive wear and tear.

Leasing vs. Purchasing a Toyota Corolla

A Toyota Corolla lease is only sometimes suited, yet it offers merits that may harmonize with your lifestyle and financial situation. Below, we outline the pros and cons of leasing a Corolla versus purchasing one.

Pros of Leasing a Corolla

- Economic Monthly Payments: Monthly lease payments are nearly 23% lower than a standard car loan. This primarily stems from the fact that lessees cover the Corolla’s depreciation costs during their possession, akin to monthly rent for the vehicle.

- Access to the Latest Models: For those seeking the latest Corolla models brimming with innovative features, leasing provides an enticing avenue. Whether it’s an XSE Apex Edition or an SE Nightshade, you can experience top-tier Corolla variants at comparably affordable rates.

- Maintenance Convenience: Since lease terms are relatively brief, the leased Corolla typically remains under manufacturer warranty. Consequently, all maintenance and repair expenses fall within the owner’s purview.

- Hassle-Free Transition: As the lease draws close, one option entails a clean break, liberating you from recurring monthly payments. Furthermore, the burden of reselling the vehicle is lifted from your shoulders.

⚡️Another article: 2010 Toyota Corolla Transmission Fluid Capacity

Cons of Leasing a Corolla

- Mileage Constraints: Frequent drivers may find leasing less accommodating. Dealerships impose mileage limits on leased vehicles to maintain their value and minimize wear and tear. Typically, mileage caps span from 10,000 to 15,000 miles annually. Violating these restrictions could result in substantial fees, often reaching 58 cents per mile.

- Wear and Tear Responsibilities: Leasing has unique responsibilities, including addressing wear and tear expenses. Fortunately, most lease agreements outline reasonable guidelines for wear and tear, with details clearly articulated in the contract. We strongly advise reviewing Toyota’s comprehensive policies regarding excessive wear and tear for additional insight.

- Absence of Ownership: The most prominent drawback of leasing is that your payments do not contribute towards building equity for a new vehicle purchase. If owning a brand-new Toyota Corolla has always been your aspiration, leasing may not align with your objectives. However, some contracts may offer the option to purchase the car once the lease concludes.

🎯Suggested article: Why Transmission Fluid Changes Are Important For Your 2017 Toyota Corolla

Key Questions to Ponder Before Leasing a Corolla

To optimize your leasing experience, a thorough self-assessment is essential. Here are pivotal questions necessitating contemplation before embarking on a Toyota Corolla lease: